SPOILER ALERT!

What Are Insurance Policy Insurance Claims Insurer - Should You Hire One?

https://penzu.com/p/91fa1615 created by-Dreier Walton

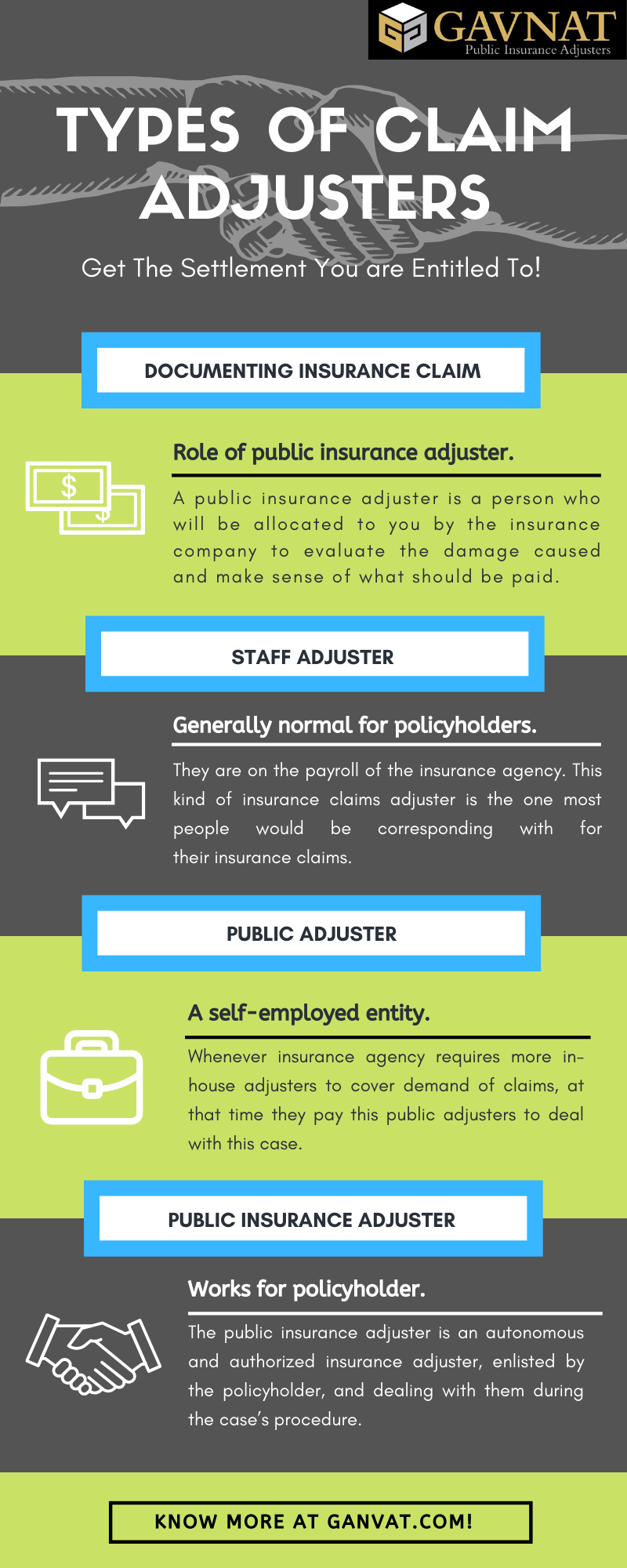

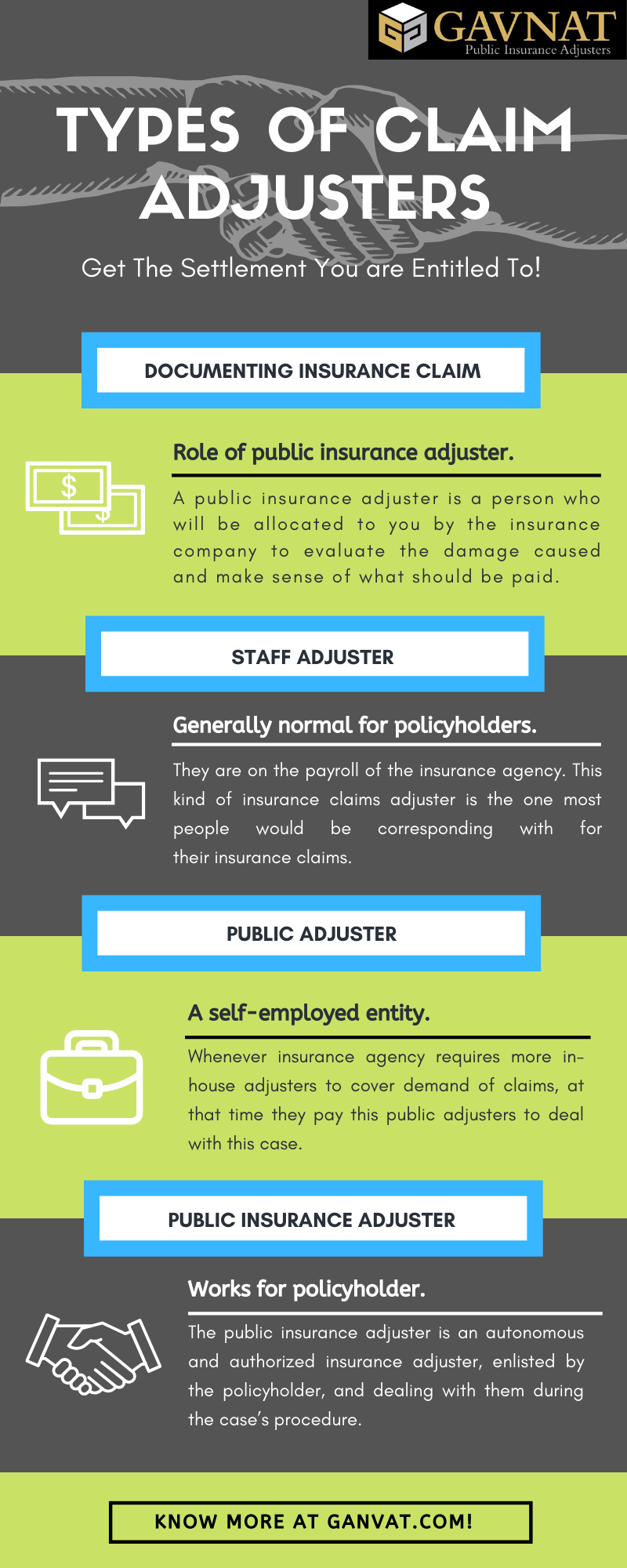

A public insurance adjuster is an independent claims handler/claims expert that represents for the insurance policy holder in working out and also aiding the insured/ insured event in helping to settle its insurance claim. Public Insurance adjusters is independent insurance representatives. They are licensed by the California Insurance Code Section 766. Public Adjusters is not employed by the insurer, yet are independent insurance policy agents who are accountable for the fiduciary task of suggesting their customers about different matters associated with their insurance coverage.

Public Insurers has 3 primary tasks. First, they need to submit all appropriate cases forms and also reports. Second, https://www.liveinternet.ru/users/vestergaard_pruitt/post482003943 must prepare the documents to effectively release or settle the case if it is rejected by the insurance provider. Third, they should provide the customer with an estimate of all necessary repair work or repair job.

Insurance companies use Public Adjusters to make the determination of the settlement amount on smaller insurance claims. The Insurance Division does not factor in the Public Adjuster's suggestion when making these determinations. If a Public Insurer believes the settlement amount must be higher than what the insurance provider figures out, she or he will certainly recommend the client to file a claim for loss backup. If the client does so, the Public Insurer receives a percent of the claimed negotiation. If the insurer agrees, then the Public Insurer concerns a final decision in the event and also forwards the suggestion to the customer.

Insurance coverage agents that represent the general public Insurance adjuster also play a vital function in the whole settlement process. Most of the times, these individuals have accessibility to delicate info. When the Public Adjuster identifies that a negotiation quantity need to be greater than what the insurer identifies, the insurance adjuster offers the information to the customer. Insurance policy agents might encourage their customer to take the deal from the insurer, if they do not want to risk needing to pay more damages. Insurance insurers are commonly the last option for clients who do not have the moment or sources to pursue alternative opportunities.

Just how can you ensure that you don't come to be the next sufferer of Insurance policy Insurance adjuster abuse? The most convenient method is to just ask the Public Insurance adjuster for paperwork regarding his or her referrals. A good Insurance agent will certainly be more than satisfied to offer such paperwork. Actually, it's far better to have documented evidence revealing that your insurance claim was certainly justified, rather than needing to turn to hasty remedies that may damage you in the future. Furthermore, you should make certain that you entirely comprehend the duty that the general public Insurer plays in your insurance industry.

Insurance Policy Representatives for Property Insurance (PIP) are required by legislation to be objective. To do this, they have to register with a nationwide association. The National Association of Insurance Policy Commissioners (NACH) has outlined rules as well as standards on how participants should behave. Amongst these are terms that insurers publicly represent the rate of interests of all policyholders, also those that may have a various viewpoint. Although NACH ensures that policyholders are treated relatively, it does not ensure that they will certainly always act in your benefit. Therefore, it's always smart to consult NACH prior to agreeing to maintain a PIP agent or adjuster on your behalf.

What is a lot more troubling regarding the current newspaper article is that numerous of the people whose houses were destroyed had not been correctly informed. Several property owners merely downplay the loss, believing that insurance coverage adjusters will certainly sort out any type of problems without trouble in any way. Actually, insurance provider are not just concerned with the payout, but additionally with guaranteeing that their client's building is structurally audio. This is why it is essential that homeowners do their own research and also get in touch with regional public adjusters and experienced house examiners to help them evaluate the damage. If house owners even doubt the legitimacy of a PIP representative, it's finest to avoid the situation completely, as fraud is equally as real as oversight.

Clearly, https://www.forbes.com/advisor/homeowners-insurance/roof-repair-scams/ have a number of worries when it pertains to insurance cases adjusters. These are very genuine worries that are worthy of major consideration, also when homeowners feel that they must have some input. As more homeowners realize the advantages of contacting regional PIP representatives and also employing them for their solutions, the variety of issues as well as mistakes ought to begin to drop. Given these things, it is clear that home owners require to make themselves a lot more familiar with all the ways they can safeguard themselves from the dangerous whims of insurance policy insurers.

A public insurance adjuster is an independent claims handler/claims expert that represents for the insurance policy holder in working out and also aiding the insured/ insured event in helping to settle its insurance claim. Public Insurance adjusters is independent insurance representatives. They are licensed by the California Insurance Code Section 766. Public Adjusters is not employed by the insurer, yet are independent insurance policy agents who are accountable for the fiduciary task of suggesting their customers about different matters associated with their insurance coverage.

Public Insurers has 3 primary tasks. First, they need to submit all appropriate cases forms and also reports. Second, https://www.liveinternet.ru/users/vestergaard_pruitt/post482003943 must prepare the documents to effectively release or settle the case if it is rejected by the insurance provider. Third, they should provide the customer with an estimate of all necessary repair work or repair job.

Insurance companies use Public Adjusters to make the determination of the settlement amount on smaller insurance claims. The Insurance Division does not factor in the Public Adjuster's suggestion when making these determinations. If a Public Insurer believes the settlement amount must be higher than what the insurance provider figures out, she or he will certainly recommend the client to file a claim for loss backup. If the client does so, the Public Insurer receives a percent of the claimed negotiation. If the insurer agrees, then the Public Insurer concerns a final decision in the event and also forwards the suggestion to the customer.

Insurance coverage agents that represent the general public Insurance adjuster also play a vital function in the whole settlement process. Most of the times, these individuals have accessibility to delicate info. When the Public Adjuster identifies that a negotiation quantity need to be greater than what the insurer identifies, the insurance adjuster offers the information to the customer. Insurance policy agents might encourage their customer to take the deal from the insurer, if they do not want to risk needing to pay more damages. Insurance insurers are commonly the last option for clients who do not have the moment or sources to pursue alternative opportunities.

Just how can you ensure that you don't come to be the next sufferer of Insurance policy Insurance adjuster abuse? The most convenient method is to just ask the Public Insurance adjuster for paperwork regarding his or her referrals. A good Insurance agent will certainly be more than satisfied to offer such paperwork. Actually, it's far better to have documented evidence revealing that your insurance claim was certainly justified, rather than needing to turn to hasty remedies that may damage you in the future. Furthermore, you should make certain that you entirely comprehend the duty that the general public Insurer plays in your insurance industry.

Insurance Policy Representatives for Property Insurance (PIP) are required by legislation to be objective. To do this, they have to register with a nationwide association. The National Association of Insurance Policy Commissioners (NACH) has outlined rules as well as standards on how participants should behave. Amongst these are terms that insurers publicly represent the rate of interests of all policyholders, also those that may have a various viewpoint. Although NACH ensures that policyholders are treated relatively, it does not ensure that they will certainly always act in your benefit. Therefore, it's always smart to consult NACH prior to agreeing to maintain a PIP agent or adjuster on your behalf.

What is a lot more troubling regarding the current newspaper article is that numerous of the people whose houses were destroyed had not been correctly informed. Several property owners merely downplay the loss, believing that insurance coverage adjusters will certainly sort out any type of problems without trouble in any way. Actually, insurance provider are not just concerned with the payout, but additionally with guaranteeing that their client's building is structurally audio. This is why it is essential that homeowners do their own research and also get in touch with regional public adjusters and experienced house examiners to help them evaluate the damage. If house owners even doubt the legitimacy of a PIP representative, it's finest to avoid the situation completely, as fraud is equally as real as oversight.

Clearly, https://www.forbes.com/advisor/homeowners-insurance/roof-repair-scams/ have a number of worries when it pertains to insurance cases adjusters. These are very genuine worries that are worthy of major consideration, also when homeowners feel that they must have some input. As more homeowners realize the advantages of contacting regional PIP representatives and also employing them for their solutions, the variety of issues as well as mistakes ought to begin to drop. Given these things, it is clear that home owners require to make themselves a lot more familiar with all the ways they can safeguard themselves from the dangerous whims of insurance policy insurers.